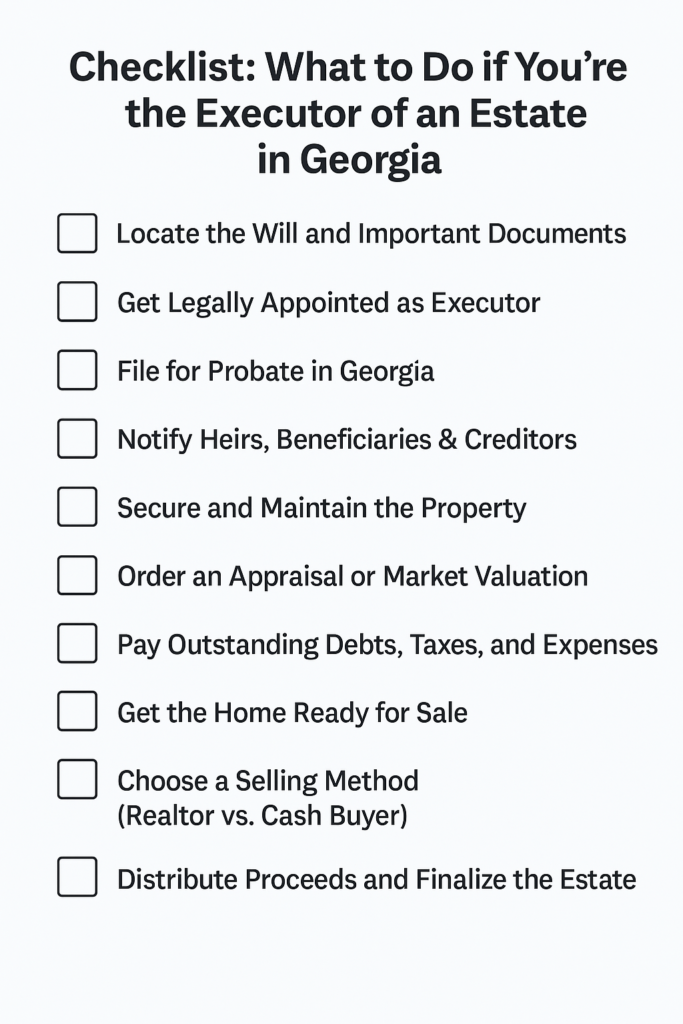

Download the PRINTABLE CHECKLIST here

Taking on the role of executor for an estate in Northwest Georgia can feel overwhelming at first, but it’s a responsibility many have handled successfully. Don’t worry; we understand how confusing this process can be. This checklist breaks everything down into easy steps to help you stay organized and reduce stress along the way.

Bonus: Looking for a detailed guide on probate and inherited property in Northwest Georgia? Grab your free copy here »

1) Find the Will and Important Papers

Start by locating the will, death certificate, deeds, financial statements, and insurance policies. These documents form the foundation of managing the estate properly. It is really helpful to make several copies and keep them somewhere safe. You will be thankful when you need to reference them later.

2) Get Officially Named Executor

Even if the will names you as executor, the probate court must make it official. This usually happens through “Letters Testamentary,” which give you legal authority to manage the estate. Without this, you will not be able to access bank accounts or sell property. Getting this paperwork done early is an important step.

Pro Tip: Do not forget to file the will with the probate court in the county where the deceased lived.

3) Start the Probate Process

You will file paperwork with the local probate court to formalize your role and begin the legal timeline. Part of this involves notifying heirs and beneficiaries. Keeping things transparent and on schedule really helps the process go smoothly.

If you are unsure where to start, the official Georgia probate court website can point you to your local court.

4) Notify Everyone Who Needs to Know

Make sure to notify all interested parties: heirs, beneficiaries, and creditors. Georgia law requires publishing a notice in a local newspaper to alert unknown creditors. Keeping a clear record of notifications saves headaches later on. It is easy to lose track of important details without a system.

You will not have to do this alone. Many executors find it helpful to work with a probate lawyer or legal assistant.

5) Protect the Property

If there is property in the estate, securing it quickly is key. Change locks if needed, confirm insurance is still active, and turn off any utilities you do not need, such as cable or internet. Keep in mind that utilities like water and electricity might need to stay on for inspections or showings. Taking care of the property helps protect its value.

Did you know vacant homes can lose insurance coverage in as little as 30 days? Acting fast is definitely smart.

Interested in hidden expenses? Check out our guide to the hidden costs of inheriting a house in Northwest Georgia.

6) Find Out What the Property is Worth

You will want to establish the fair market value of the property as of the date of death. This value is important for the court’s inventory and tax purposes. If the property is valuable or heirs disagree on the price, a certified appraisal is often the best choice.

Work with a licensed real estate agent or appraiser familiar with the Northwest Georgia market.

7) Pay Debts, Bills, and Taxes

Before you distribute assets, make sure to pay all valid debts and expenses. This includes mortgages, credit cards, medical bills, funeral costs, property taxes, and more. Cancel subscriptions and notify service providers as well.

Keeping detailed records of payments will make court reporting much easier. You can learn more about federal estate and gift taxes on the IRS website here.

If you are unsure about which debts are valid, talking to a probate attorney or accountant can help protect you from personal liability later.

Don’t skip this step; it’s a legal requirement in Georgia.

8) Prepare the Home for Sale

If you plan to sell the home, start by clearing out personal items and securing valuables. Safely dispose of anything hazardous or expired. A deep clean, junk removal, or staging can really help the home look its best.

Simple updates like painting or yard work can make a big difference. For bigger repairs, get estimates first to decide if you want to sell as-is or invest in improvements.

Need more tips? Check out our full checklist for selling inherited properties.

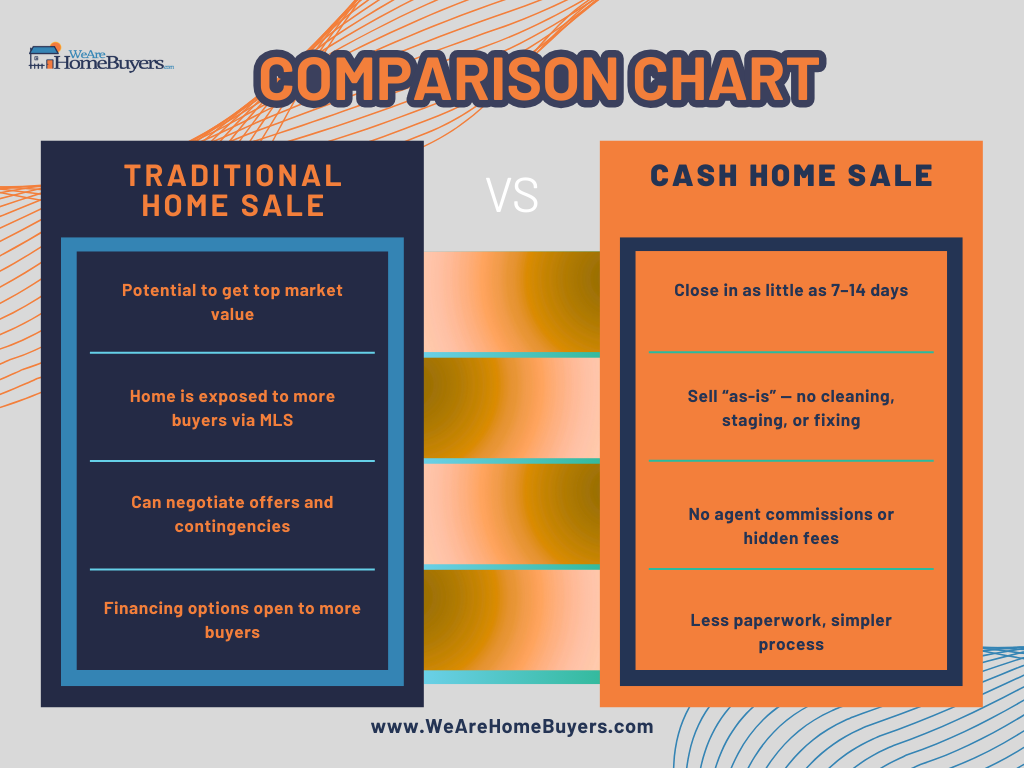

9) Decide How You Want to Sell (REALTOR ® vs. Cash Buyer)

When it is time to sell, you have options. Listing with a real estate agent might get you top dollar but usually means preparing the home, hosting showings, and waiting for offers. Selling on your own gives you control but means more work.

Or, you could sell to a cash buyer. This is often the quickest and easiest way, with no repairs, no cleaning, and no waiting. If you want to skip the hassle, We Are Home Buyers can provide a fair cash offer. Just call us at (706) 670-6886 or fill out a form on our website to get started.

10) Finish Up and Distribute the Money

Once the home sells and debts are paid, you will distribute the remaining funds to heirs. Follow the will’s instructions or Georgia’s inheritance laws if there is no will. Keep thorough records, and file a final report with the court if needed.

Once the court signs off, the estate is officially closed.

Bonus: Get Your Printable Checklist

Want a printable version of this checklist? Grab it here:

Common Questions Executors Ask

Can I sell estate property in Georgia?

Yes. Once the probate court officially appoints you executor, you have legal authority to sell inherited real estate. The sale should be in the best interest of the estate and follow the will’s instructions or Georgia law if there is no will. Selling estate property can be a big step, so it is important to keep thorough records and communicate with the court and heirs.

Do I have to hire a lawyer?

Not necessarily. Georgia law does not require an attorney to probate a will, but having one can be very helpful. Especially if there are multiple heirs, complex assets, unclear instructions, or disputes. A probate lawyer can guide you, help you avoid mistakes, and handle legal paperwork, saving you time and stress.

How long does probate usually take?

Probate in Georgia usually takes six to twelve months. But this varies depending on the estate’s size, complexity, contested wills, or legal challenges. Staying organized, filing paperwork on time, and communicating clearly can help keep things on track and avoid delays.

Can I sell the house before probate ends?

In some cases, yes. If you are legally appointed executor and the will allows it, you may be able to sell estate property during probate. However, it is very important to check with a probate lawyer first. Selling too early or without proper authority can cause problems. A lawyer will help make sure everything is done right.

What if the house needs a lot of work?

You do not have to fix anything before selling. Many executors sell the home “as-is” to avoid time, expense, and hassle. This can be a smart choice if the home needs major repairs or you want to close quickly. At We Are Home Buyers, we buy homes in any condition. You will not have to worry about cleaning, repairs, or upgrades.

What if I do not live in Georgia but I am the executor?

No problem. You can manage everything from out of state. You will probably want to hire a local attorney or representative to help with court filings, property care, and other tasks that require being there in person. Staying organized and communicating regularly with your local team will keep things running smoothly. Many out-of-state executors handle Georgia estates this way successfully.

In Summary

If you ever feel uncertain about your next step, please do not hesitate to reach out to our team at We Are Home Buyers. We are here to support you every step of the way with guidance and a no-pressure cash offer to help you move forward with your inherited property.