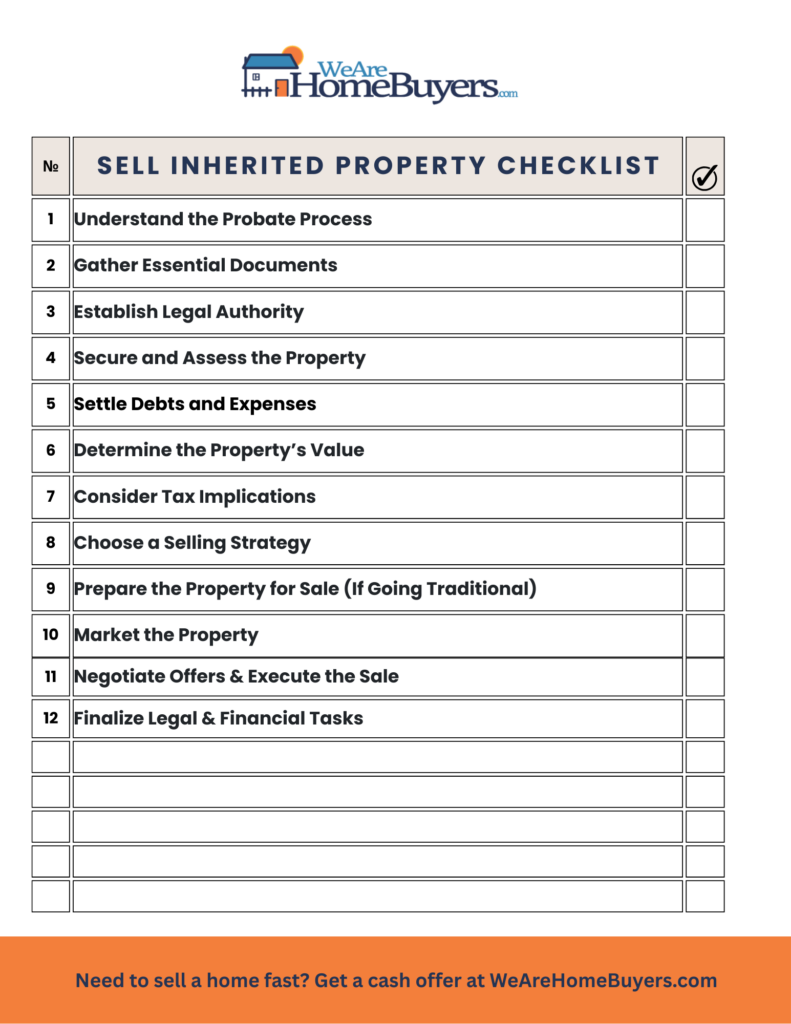

Download the PRINTABLE CHECKLIST here

Inheriting a house sounds like a blessing, until you realize you have to sell it. Probate? Taxes? Documents? Yeah, it gets messy.

This step by step checklist walks you through everything you’ll need to sell an inherited property in Georgia, smoothly, legally, and with as little stress as possible.

Bonus: Grab our free guide to probate and inherited property in Georgia here »

1) Understand the Probate Process

If probate is required, you’ll need to file with your county’s probate court. It can take up to 12 months in Georgia. If the property is in a trust or was jointly owned, probate might not be necessary.

Pro Tip: Talk to a probate attorney early to avoid costly mistakes or delays during the sale.

2) Gather Essential Documents

Keep these organized in a single folder:

- Will, death certificate, probate court papers

- Property deed

- Mortgage and lien info

- Tax history

- HOA docs, utility bills, insurance policy

You’ll need these for the attorney, agent, or buyer, don’t wait until closing.

3) Establish Legal Authority

Only the executor or administrator appointed by the court can sell the home. You’ll need “letters testamentary” or “letters of administration” to prove it.

Without legal authority, you can’t legally sign contracts, access financials, or transfer the deed.

4) Secure and Assess the Property

Start by changing the locks to secure the property. If there isn’t anyone living in the home, you might think about shutting off the gas and water. But if you’re planning to put it on the market, it’s usually better to keep the utilities running, buyers expect lights, running water, and a comfortable temperature when touring a home. And if it’s cold outside, you’ll either need to leave the gas on to keep the pipes from freezing or properly winterize the house to avoid costly damage.

Also check the status of the homeowner’s insurance, it may be voided if the home is vacant too long. This is happening more often, don’t overlook this step.

5) Settle Debts and Expenses

This includes:

- Mortgage balance

- Property taxes

- Utility bills

- HOA or code enforcement fines

Get payoff statements early to avoid closing delays.

6) Determine the Property’s Value

Hire a real estate agent or appraiser to find the fair market value. This also helps you calculate capital gains tax if the home sells for more than it was worth at time of death.

Homes priced accurately from the start sell faster and avoid sitting on the market.

7) Consider Tax Implications

You may not owe capital gains tax thanks to the “step-up in basis,” but if the home increases in value after you inherit it, you might.

Consult a CPA about exemptions, deductions, and sale timing.

8) Choose a Selling Strategy

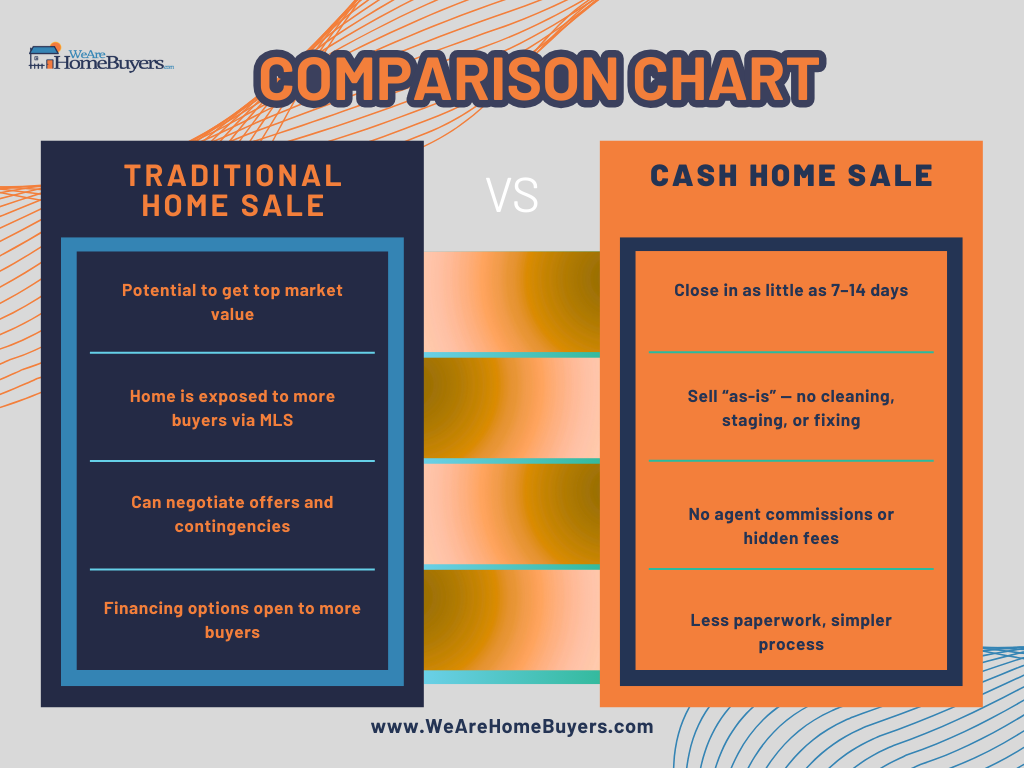

Choose what fits your goals and timeline:

- REALTOR ®. – max value, slower close

- FSBO – save money, requires effort

- Cash buyer – fastest, sells as-is, no showings

We help sellers close fast and avoid probate chaos, get an offer here.

9) Prepare the Property for Sale (If Going Traditional)

Basic updates and cleaning go a long way

- Remove personal items

- Patch obvious damage

- Neutralize weird smells or paint colors

Buyers decide within 8 seconds, make it count.

10) Market the Property

Great listing photos, a strong description, and multiple channels (MLS, Zillow, Facebook) are key if you go the retail route.

Highlight location, lot size, upgrades, and school zones if relevant.

11) Negotiate Offers & Execute the Sale

Compare buyer terms: price, contingencies, timeline. Don’t jump at the first offer unless it checks all your boxes.

Pro tip: Some cash buyers waive inspections and close in 7 days.

12) Finalize Legal & Financial Tasks

At closing:

- Transfer the deed

- Pay off debts

- Distribute any funds to heirs

- Cancel utilities, insurance, etc.

Keep a copy of every document, you’ll need it for taxes or estate reporting.

Need Help Selling an Inherited Property in Georgia?

We help Georgia families sell inherited homes fast, as-is, and without legal headaches.

- No commissions

- We handle probate complications

- Close in as little as 7 days

Get your free offer now »

Download the full Probate & Inherited Property Guide »

Frequently Asked Questions (FAQ’s)

Can I sell an inherited house in Georgia before probate is complete?

In most cases, no, you’ll need to complete the probate process or be granted legal authority as the executor or administrator before you can sell the home. However, if the home was held in a trust or jointly owned with rights of survivorship, probate may not be required. It’s best to speak with a probate attorney or title company familiar with Georgia law.

What documents do I need to sell an inherited property in Georgia?

You’ll need several key documents, including the death certificate, will or probate court order, property deed, tax records, mortgage/lien information, and proof of your legal authority to sell (like Letters Testamentary). Having these ready speeds up the sale process and prevents closing delays.

Do I have to pay taxes on an inherited property in Georgia?

Georgia doesn’t have an inheritance tax, but you may owe federal capital gains tax if the home sells for more than its fair market value at the time of inheritance. The IRS allows a “step-up in basis,” which can significantly reduce what you owe. Always check with a CPA.

How long does probate take in Georgia?

Probate typically takes 8 to 12 months in Georgia, depending on the complexity of the estate, whether there’s a will, and if any heirs contest the process. Some “uncontested” cases may close faster. The sooner you file, the sooner you can sell the property.

What if my siblings don’t agree on selling the inherited house?

Disagreements between heirs are common. Ideally, all heirs should sign off on the sale. If someone refuses, legal action may be required to partition or force a sale. Mediation or involving an estate attorney early can help resolve disputes before they get costly.

Can I sell an inherited house that’s in poor condition or has tenants?

Yes, many inherited homes are sold “as-is,” even with needed repairs or existing tenants. You may want to sell to a cash buyer to avoid the time and cost of renovations or eviction. Make sure you disclose all known issues upfront.