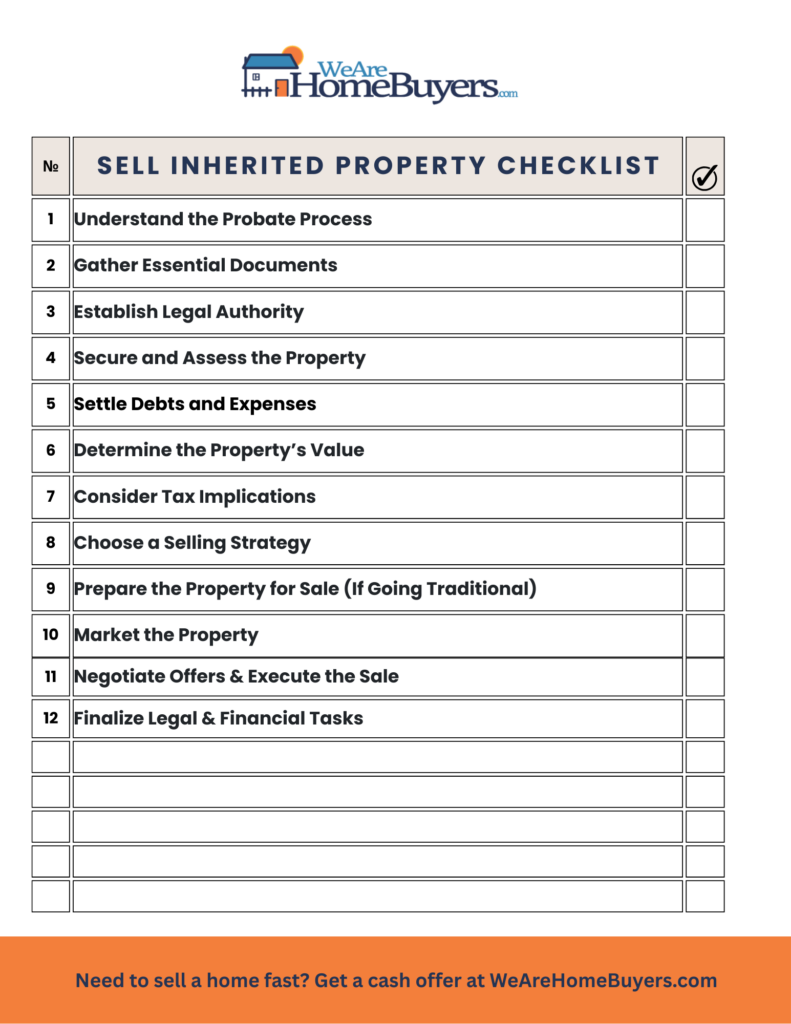

Download the PRINTABLE CHECKLIST here

Inheriting a house might feel like a blessing at first until you realize you have to sell it. Probate, taxes, paperwork; it can get messy fast.

This step-by-step checklist will guide you through everything you need to do to sell an inherited property in Georgia smoothly, legally, and with as little stress as possible.

Bonus: Grab our free guide to probate and inherited property in Georgia here »

1) Understand the Probate Process

If probate is required, you will need to file with your county’s probate court. In Georgia, this process can take up to 12 months. However, if the property is held in a trust or was jointly owned with rights of survivorship, probate might not be necessary.

Pro Tip: Talk to a probate attorney early to avoid costly mistakes and delays during the sale.

2) Gather Essential Documents

Keep everything organized in one folder to avoid scrambling later:

- Will, death certificate, probate court papers

- Property deed

- Mortgage and lien information

- Tax history

- HOA documents, utility bills, insurance policy

You will need these for your attorney, real estate agent, or potential buyers. Do not wait until closing to get them ready.

3) Establish Legal Authority

Only the executor or administrator appointed by the court has the legal authority to sell the home. You will need “letters testamentary” or “letters of administration” to prove your role.

Without this legal authority, you cannot sign contracts, access financial accounts, or transfer the property deed.

4) Secure and Assess the Property

Start by changing the locks to secure the home. If no one lives there, you might consider shutting off gas and water to avoid unnecessary bills.

However, if you plan to list the property, it is usually better to keep utilities running. Buyers expect to tour a home with lights on, running water, and a comfortable temperature. If it is cold outside, either keep the heat on to prevent frozen pipes or properly winterize the house to avoid costly damage.

Also, check the homeowner’s insurance policy. Some policies become void if the home stays vacant too long. This is increasingly common, so do not overlook this step.

5) Settle Debts and Expenses

Make sure to take care of:

- Mortgage balance

- Property taxes

- Utility bills

- HOA fees or code enforcement fines

Request payoff statements early to avoid delays at closing.

6) Determine the Property’s Value

Hire a real estate agent or professional appraiser to determine the fair market value. This helps you price the home correctly and calculate any capital gains tax if the property sells for more than its value at the time of inheritance.

Homes priced accurately from the start tend to sell faster and avoid sitting on the market.

7) Consider Tax Implications

You may not owe capital gains tax thanks to the “step-up in basis,” which adjusts the property’s value to its market value at the time of death. However, if the property appreciates after you inherit it, you might owe taxes on that gain.

Consult a CPA to understand exemptions, deductions, and the best timing for the sale.

8) Choose a Selling Strategy

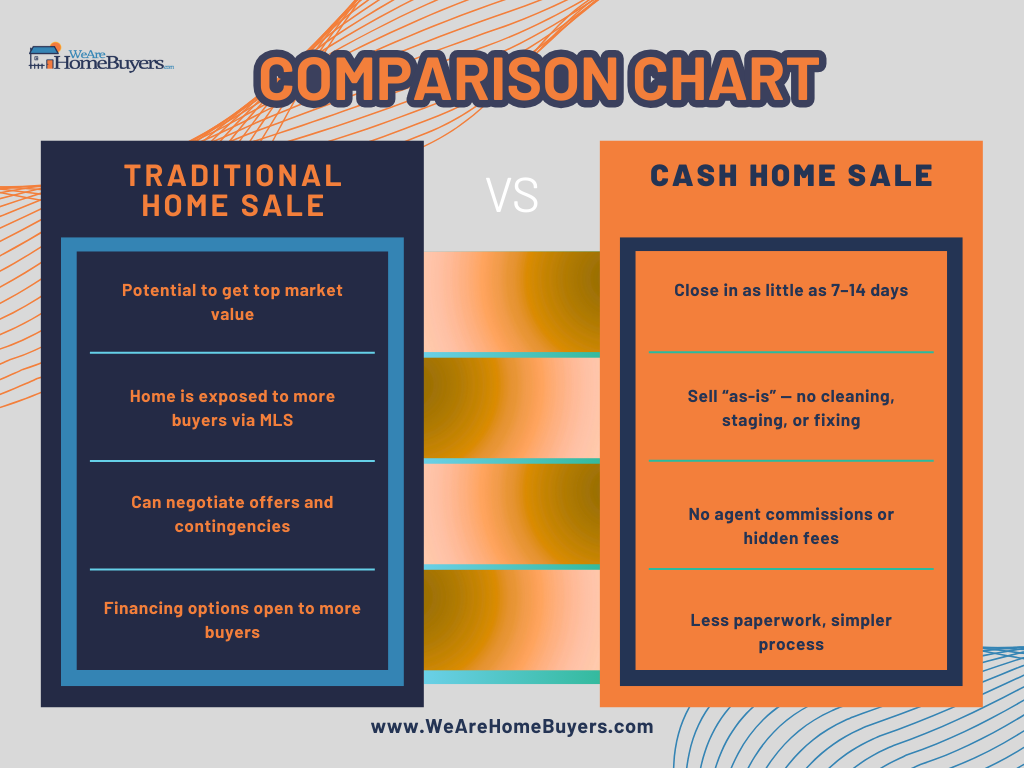

Pick the option that fits your goals and timeline:

- REALTOR ®: Maximize value but expect a slower closing

- FSBO (For Sale By Owner): Save money but requires effort

- Cash buyer: Fastest, sells as-is with no showings

We help sellers close fast and avoid probate chaos. Get an offer here.

9) Prepare the Property for Sale (If Going Traditional)

Basic updates and cleaning can make a big difference:

- Remove personal items

- Patch obvious damage

- Neutralize strong odors or unusual paint colors

Remember, buyers decide within seconds. Make those first impressions count.

10) Market the Property

Strong listing photos, a compelling description, and exposure across multiple channels such as MLS, Zillow, and Facebook are key if you are selling traditionally.

Highlight the location, lot size, upgrades, and nearby schools if relevant.

11) Negotiate Offers & Execute the Sale

Compare buyer terms like price, contingencies, and closing timeline. Do not rush to accept the first offer unless it meets your needs.

Pro tip: Some cash buyers waive inspections and close within a week.

12) Finalize Legal & Financial Tasks

At closing:

- Transfer the deed

- Pay off debts

- Distribute funds to heirs

- Cancel utilities and insurance

Keep copies of all documents for taxes and estate reporting.

Need Help Selling an Inherited Property in Georgia?

We help Georgia families sell inherited homes fast, as-is, and without legal headaches.

- No commissions

- We handle probate complications

- Close in as little as seven days

Get your free offer now »

Download the full Probate & Inherited Property Guide »

Selling an Inherited Home in Georgia? Here Are the Answers You Need

Can I sell an inherited house in Georgia before probate is done?

This is such a common question, and you are definitely not alone if you are feeling confused. Most of the time, you will need to go through probate first. The court has to officially put you in charge by naming you as the executor or administrator before you are allowed to sell the house. That said, there are a few exceptions. If the house was left to you through a trust or you owned it jointly with rights of survivorship, you might be able to skip probate entirely. The quickest way to know for sure is to reach out to a probate attorney or a local title company. They can take a look at your situation and explain what steps you need to take.

What paperwork do I need to sell an inherited house?

There is definitely some paperwork involved, but it is a lot easier to handle if you get it all together early. You are going to need the death certificate, a copy of the will or probate court order, the property deed, and any mortgage payoff statements. It is also smart to gather tax records and any HOA documents if they apply. On top of that, you will need something called Letters Testamentary or Letters of Administration, which basically show that you are the one who has permission to sell the house. Getting this part organized upfront will save you a lot of headaches later, especially when it is time to close.

Am I going to owe taxes when I sell the house?

This is one of those things people worry about, and honestly, it is not as bad as you might think. Georgia does not charge an inheritance tax, so that is already a win. You might owe some federal capital gains tax, but thanks to something called a step-up in basis, many people do not end up owing much at all. This rule resets the value of the house to what it was worth when you inherited it, which can lower or even wipe out your tax bill. Still, it is always smart to double-check with a CPA just to be sure. A quick conversation with a tax professional can give you peace of mind before you sell.

How long does probate actually take in Georgia?

If you are hoping for a quick process, it helps to be realistic. Probate usually takes anywhere from eight to twelve months in Georgia. Some people get through it faster if everything is simple and there are no family disagreements. Other times, it can drag on a bit longer if there are complications. The good news is that starting early makes a big difference. An experienced probate attorney can also help you avoid some of the common slowdowns and keep things moving as smoothly as possible.

What if my siblings or other family members do not agree about selling?

Family disagreements are very normal when it comes to inherited property, so you are definitely not the only one dealing with this. The best-case scenario is that everyone agrees and you can move forward without any problems. Unfortunately, that is not always how it plays out. If one person refuses to sell, you might need to bring in an estate attorney. Sometimes just having a neutral person involved can help settle things. Other times, you may need to go through mediation or take legal action with a partition sale, where the court steps in and orders the sale. It really helps to talk with a professional early before things get too complicated.

Can I sell the house if it needs a lot of work or has tenants?

Yes, absolutely. You do not have to fix up the house or evict tenants before selling. A lot of people inherit properties that need repairs or already have renters living there. If you do not want to take on those extra projects, you can sell the house as-is. Many cash buyers will take care of everything, including any repairs or dealing with tenants, which saves you a lot of time and hassle. Just make sure you are upfront about the condition of the house so there are no surprises later. It is definitely possible to sell quickly without worrying about making the property perfect.